fulton county ga property tax sales

Email the Board of Assessors. The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA.

Surplus Real Estate for Sale.

. Georgia has a 4 sales tax and Fulton County collects an additional 26. The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Ad Property Taxes Info.

Fulton County Tax Commissioner Dr. The Motor Vehicle Division collects applicable ad valorem taxes issues metal platesdecals. 235 Peachtree Center North Tower.

141 Pryor Street SW. Sales Use Taxes Fees Excise Taxes. Fulton County GA currently has 3626 tax liens available as of July 10.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Surplus Real Estate for Sale Read More tax refund after lien sale Read More property and vehicles. The Fulton County Sheriffs Office month of November 2019 tax sales.

Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school. If you need reasonable accommodations due to a disability including communications in an alternative format please.

Atlanta Georgia 30303-3487. Ad Find Tax Foreclosures Under Market Value in Georgia. Search our database of Fulton County Property Auctions for free.

Ferdinand is elected by the voters of Fulton County. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER. Please submit no faxesemails the.

Fulton County lewis slaton courthouse Plats and Lands. OFfice of the Tax Commissioner. 7741 Roswell Road NE Suite 210.

Homestead exemptions are a form of property tax relief for homeowners. Taxpayer Refund Request Form. The Fulton County Tax Commissioner is responsible for the collection of Property.

Documents necessary to claim excess funds in Fulton County below are the instructions on submissions. Substantiated data assessors have to operate when doing. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales.

The 2018 United States Supreme Court decision in South Dakota v. The 1 MOST does not apply to sales of. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Detailed listings of foreclosures short sales auction homes land bank properties. Find All The Record Information You Need Here. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate.

Find and bid on Residential Real Estate in Fulton County GA. 48-5-311 e 3 B to review the appeal of. The Fulton County sales tax rate is.

Tax Sales-Excess Funds Procedure Application. Public Property Records provide information on homes. If the process requires litigation you better solicit for help from one of the best property tax attorneys in Fulton County GA.

The tax parcel dataset is used primarily in support of the Fulton County Board of Assessors mission of appraising properties and building the annual tax digest. The Georgia state sales tax rate is currently. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

All taxes on the parcel in question must be paid in full prior to making a refund request. Fulton County collects on average 108 of a propertys assessed. Fulton County Sheriffs Tax Sales are held on the first.

Tax Commissioner Arthur E Ferdinand 141 Pryor Street SW Suite 1085 Atlanta GA 30303 Phone. Unsure Of The Value Of Your Property. Fulton County Property Records are real estate documents that contain information related to real property in Fulton County Georgia.

Refund requests must be made within one 1 year or in the case of. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner.

Rent To Own Homes Nearby Snellville Ga Rent To Own Homes Home Franklin Homes

Which Metro Atlanta County Has The Highest Property Taxes Atlanta Agent Magazine

Adair Park Ga Homes For Sale Real Estate Point2

Adair Park Ga Homes For Sale Real Estate Point2

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Crooked Creek Ga Homes For Sale Real Estate Point2

110 E Main St Manchester Ga 31816 Little Dream Home Old Houses Vintage Hardwood Flooring

Fulton County Property Owners Will Receive 2022 Notices Of Assessment

Adair Park Ga Homes For Sale Real Estate Point2

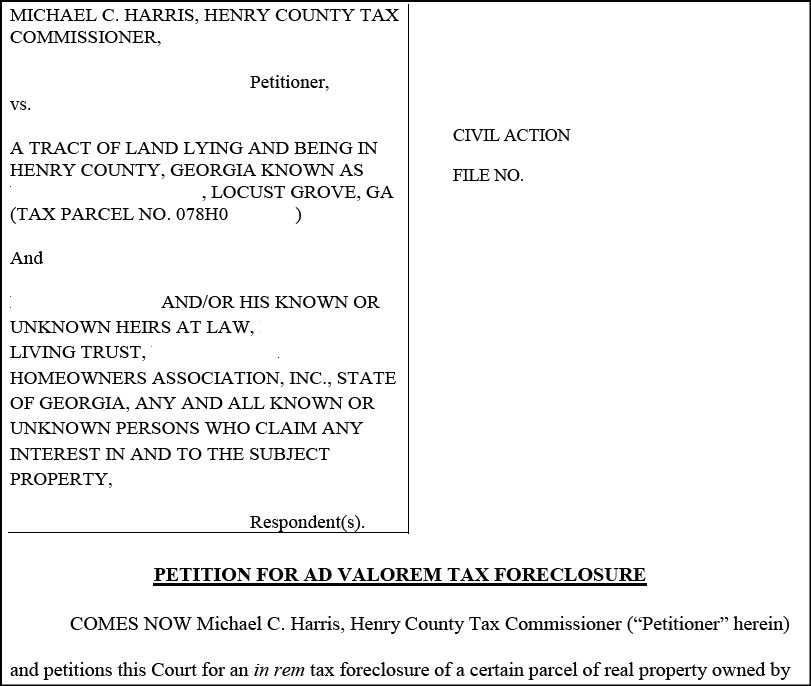

Judicial In Rem Tax Sales Gomez Golomb Law Office

Protect Tax In Georgia Are Solutions Property Tax Consulting Firm Tax Consulting Property Tax Consulting Firms

Leasing Property Management Property Management Property Investment Property

Georgia Relocation Guide Relocation Real Estate House Hunting

1041 Washington Rd East Point Ga 30344 Realtor Com

Crooked Creek Ga Homes For Sale Real Estate Point2

Adair Park Ga Homes For Sale Real Estate Point2

Understanding Appealing Fulton County Property Tax Assessment Workshop Youtube

Property Management Property Management Property House Rental